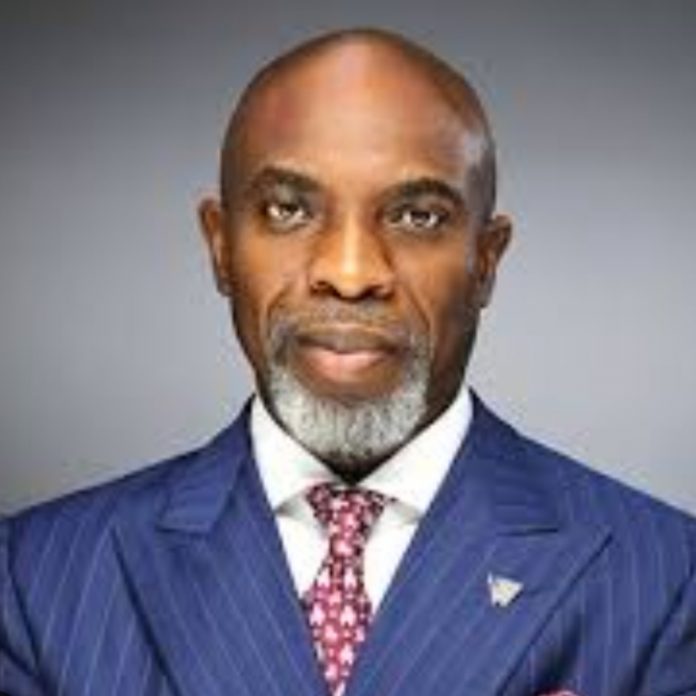

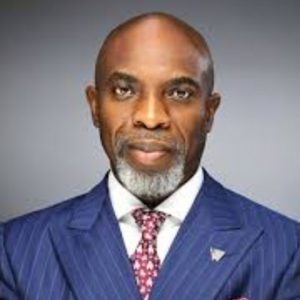

Wema Bank MD, Moruf Oseni

By Our Reporter

The managing director ofWema Bank Plc, Mr. Moruf Oseni is literally running from pillar to post to exonerate self from the N1.27 trillion undisbursed intervention money palavar.

Mr. Oseni is not alone in this scandal, as other senior bank officials are also alleged to be involved and may be invited by special investigator Mr. Jim Obazee to testify regarding the management of intervention funds that the apex bank released to the lender in order to investigate the operations of the Central Bank of Nigeria (CBN) and its associated entities.

The officials of the bank are expected to be interogated any moment from now.

“Yes the MD and other management staff will soon be quizzed over their role in the N1.27 trillion undisbursed intervention money at various commercial banks in Nigeria, which included Wema Bank, according to a report by The Punch.

It was discovered that the action was taken to investigate any irregularities in the lender’s administration of the intervention funds. This followed the discovery of anomalies and abnormalities in the financial statements by a committee looking into the apex bank.

A special investigator inagurated by President Bola Tinubu is currently looking into the financial services industry regulator, and in August, the CBN revealed its financial statements for the years 2016 to 2022. On July 28, Tinubu appointed Jim Obazee, a former CEO of the Financial Reporting Council of Nigeria, as a special investigator to look into the actions taken by the top bank while its governor, Godwin Emefiele, was on suspension. Recently, George Akume, the secretary to the Government of the Federation, stated that the Federal Government would shortly release the audit report of the investigation into the CBN.

According to the SGF, if the CBN investigation report is made public, it would show how bad leadership contributed to the nation’s current situation.

Akume stated that the study will help Nigerians understand what actually went wrong and how the nation ended itself in its current predicament.

The research claims that the intervention funds, particularly the Commercial Agriculture Credit Scheme and the Anchor Borrower Fund, have mostly benefited the agriculture sector. Nine banks have at least N208.33 billion in CBN funds that have not yet been distributed for the Commercial Agriculture Credit Scheme and the Anchor Borrower Fund, both of which have low-interest rates.

Wema Bank Plc stated that it had N848.23 million of the AB Fund in its bank accounts from N1.96 billion, indicating that it had disbursed N846.26 billion between January and June 2023. This information was contained in the first half financial results provided to the Nigerian Exchange Limited. The CBN created the Anchor Borrowers’ Program in accordance with its developmental role.

On November 17, 2015, former president Muhammadu Buhari created it in order to establish a connection between smallholder farmers and the anchor corporations that handle important agricultural commodities.

The CACS is a program run by the CBN in partnership with the Federal Ministry of Agriculture and Rural Development, which is the representative of the Federal Government, with the goal of promoting commercial agricultural firms in Nigeria by offering agriculture concessionary funding.

Controversies have so far surrounded the ABP fund’s recipients and repayments. As of the time of publication, Mabel Adeteye, Director of Brand & Marketing Communications at Wema Bank Plc, had not responded to enquiries from newsmen