UBA MD, Oliver Alawuba, UBA headquarters

By Victory Oghene

An account holder with the United Bank of Africa, (UBA) Bamidele Dayo, who is also a Nigerian student in the United Kingdom has narrated how the sum of N2.27m mysteriously disapper ed from his account.

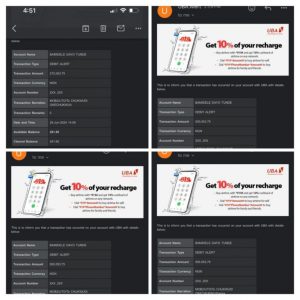

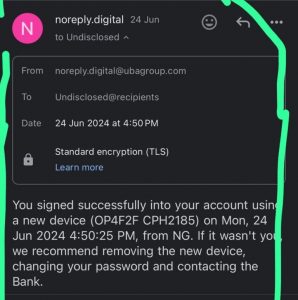

Dayo said he transferred N10,000 from his United Bank for Africa (UBA) account on June 25, 2024 only to get a series of strange debit alerts on his phone: N500,000 in four places and an extra N272,000.

Dayo said “That was how I lost N2.272 million. But when I contacted UBA, their forensic investigation did not show how my money got stolen”

Dayo, who is studying to get a master’s degree said that he got an email notification that another phone had been attached to his UBA app. He found this rather shocking as he had not handed his phone or account details to a third party.

“I could log in, yet someone some where in Nigeria could still log in on the same mobile app. I wondered how two mobile devices could be attached to one account without me getting an OTP (one-time password)

He also explained that the debit was done through a mobile transfer by the same account that was attached to his account.

Dayo also said that he called UBA’s fraud help desk immediately and they told him they would swing into action. He said that the fraud desk told him they would have to lock his account for a forensic investigation to settle the dispute.

“UBA came up with a forensic report, showing clearly that the app that was used to move that money was excluded from their forensic investigation, which means they could not trace the app that was newly attached to the account that was used to move the money,” Dayo told FIJ.

In the forensic report by UBA, the bank documented that the disputed transaction had been “carried out using his log-in details, and

validated with sensitive authentication data” known to Dayo alone.

“A review of our UBA Mobile Banking enrolment log confirmed that your account was created on the platform on May 31, 2023, another device was added on September 21, 2023, and March 28, 2024, using your valid account credentials and a verification code which was used to

successfully complete/activate the enrolment process was delivered to

your mobile number…,” another section of the forensic reads.

Dayo explained that he once went to a UBA branch in Ikorodu to rectify a bank issue on September 21, while March 21 was the day he changed to a new device in the UK. He also said he had retained possession of his old phone since then.

“Those are the verified devices that were attached to my account, and for them, an OTP was sent to my account, but the one that was used to move my money, there was no OTP sent to me and UBA did not include it in their forensic report,” said Dayo

“The money was sent to a Moniepoint account.”

Dayo also said that the loss had affected his fee payment and he had to take a loan to pay his tuition.

Dayo suspected foul play and employed the services of a lawyer. But when his lawyer reached out to UBA via a letter, the bank responded that it would conduct a fresh investigation on July 1.

“We did not get any reply from them till the end of July. So, I told the lawyer to write a reminder note which he sent to them on August 8,”

“UBA now handed a letter that should have got to the lawyer on the 18th of July, but they didn’t send it to him until August 8 when he went to give them the reminder. But what they sent to the lawyer was exactly the same thing as the first forensic report they had sent to me earlier.”

NATIONAL WAVES contacted Ramon Nasir of the Corporate Communica tions department of UBA over the matter, he was yet to respond as at the time of filling this report