1. The main objective of this project is to implement a robust ICT System for the collection of Expatriate Employment Levy. The specific objectives include:

a. Improve revenue generation from the non-oil sector to the FGN;

b. Ensure fiscal transparency and performance of the FGN;

c. Promote ease of doing business in Nigeria;

d. Enhance technology and knowledge transfer;

e. Generate employment opportunities for Nigerians;

f. Provide fair employment for low paid jobs by expatriates to Nigerian work force capable and willing to take these positions.

g. Increase employment income for Nigerians;

h. Upskilling and promotions for Nigerians who can perform expatriate jobs and contribute to more pensions;

i. Reduce Foreign Exchange Pressure for overseas salaries for expatriates;

j. Increase profitability of companies by having reduced costs and contributing higher profits and eventually higher corporate taxes paid.

2. The Proposed Expatriates Employment Levy project is intended to ensure that the country derives the full benefit associated, from the incomes derived by expatriates resident in the country, like all other countries. Unlike the present situation where majority of the expatriates resident in Nigeria only get paid their allowances here, while their main earning is paid in their home-countries. This deprives the country of benefitting from the income earned from the country by the expatriates and also encourages the habit of bringing low-skill workforce into the country as expatriates for jobs that Nigerians can perform and are trained to do in abundance, denying them.

3. The EEL will ensure that expatriates working in the country are charged a fixed annual levy to make up for the inability to tax their real earnings due to the habit of only paying them allowances in the country and indirectly avoiding the payment of appropriate taxes, thereby short-changing the nation. The EEL is also meant to discourage the habit of flooding the country with low-skill workforce and denying willing and able Nigerians the opportunity to be employed and engaged.

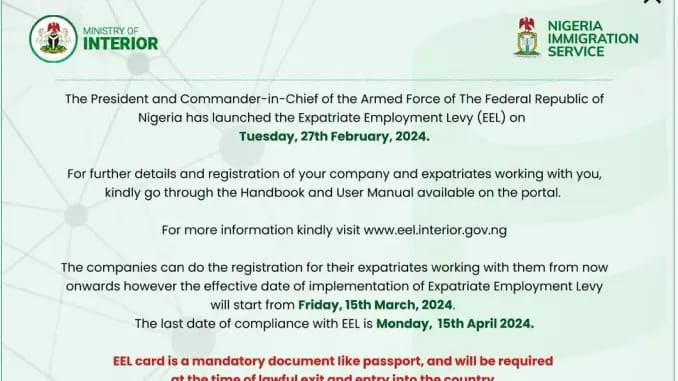

4. The proposed Expatriate Employment Levy (EEL) Collection System will be implemented to ensure that the levy collection management is automated to achieve revenue assurance in line with the FGN’s efforts to improve revenue, block tax leakages, create new income sources, and promote effective revenue/levy collection to be used for the benefit and progress of the nation and citizens.

5. The EEL will be implemented by applying fixed levies per year, to vary according to the expatriate’s position (directorate position or other quotas).

6. The project falls within the Renewed Hope Agenda of President Bola Ahmed Tinubu’s administration, with the objective of enhancing revenue generation and increasing the income to GDP ratio as obtainable in other countries.