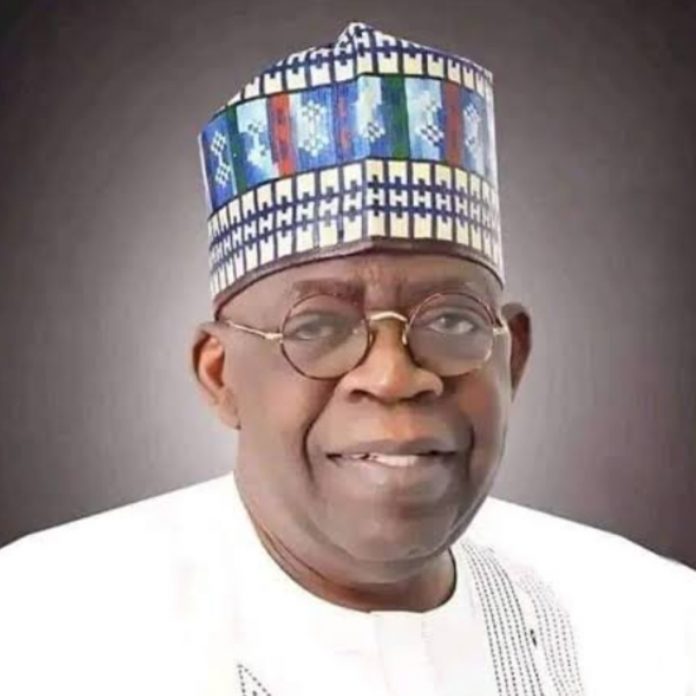

President Bola Tinubu

The ongoing opposition from a wide spectrums of interests to the President Bola Tinubu tax bill is a cautionary tale for the current and future administrations on the need for wider consultations before a critical and important policy is rolled out, especially sensitive ones that will have broad ramifications for the country.

The Tax Reform Bill sent to the National Assembly by the President is meant to streamline the tax system, reform it for efficiency, according to the proponents.

But interpretation and perspective on the implications have differed, with regional interests such as Northern Governors Forum leading opposition to it.

The 19 state governors in the Northern region have aired their strong displeasure at the Tax Reform Bill the Federal Government submitted to the National Assembly for approval.

The governors particularly rejected the proposed shift to a Derivation-based Model for Value Added Tax distribution.

They claim that the proposed model would be at the disadvantage of the northern states and other less industrial regions.

The governors, under the auspices of the Northern States Governors’ Forum, voiced their strong opposition in a communique issued after a strategic meeting in Kaduna earlier in the week.

The communique was read by the Chairman of the NSGF and Governor of Gombe State, Muhammad Yahaya.

The meeting included northern traditional rulers, the Chief of Defence Staff, General Christopher Musa, and other key stakeholders.

The latest development comes amid multiple debates surrounding resource control and the distribution of Value Added Tax revenue among states. Many northern states where Sharia law is practiced prohibit the sale of alcoholic beverages but still receive a share of VAT collected from alcohol sales.

However, in the new tax reform bill, the Taiwo Oyedele-led panel proposed the amendment of the distribution formula to a Derivation-based Model.

Disapproving this policy, the governors said that VAT is currently remitted based on the location of company headquarters rather than where goods and services are consumed.

They added that the measure will negatively affect the distributed revenue from the Federal Accounts Allocation Committee.

The communique read in part, “The forum notes with dismay the content of the recent Tax Reform Bill that was forwarded to the National Assembly. The contents of the reforms are against the interest of the North and other sub-nationals, especially the proposed amendment to the distribution of Value Added Tax to a Derivation-based Model.

“This is because companies remit VAT using the location of their headquarters and tax office where the services and goods are consumed. In view of the foregoing, the Forum unanimously rejects the proposed Tax Amendments and calls on members of the National Assembly to oppose any bill that can jeopardise the well-being of our people.”

The forum further demanded equity and fairness in national policy implementation and no geopolitical zones should be shortchanged.

“For the avoidance of doubt, the Northern Governor’s Forum is not averse to any policies or programmes that will ensure the growth and development of the country.

On Thursday, the 36- state governors rejected the bill, while the members of the National Assembly have also rejected it also making the case for more consultations.

The governors, speaking during the National Economic Council – Nigeria’s highest economic advisory body – meeting on Thursday, asked President Bola Tinubu to withdraw the Reforms Bill from the National Assembly for more comprehensive consultations.

Oyo State Governor, Seyi Makinde, announced this as part of resolutions reached at the council’s 144th meeting chaired by Vice President Kashim Shettima at the State House, Abuja.

Makinde told journalists that council members agreed that it was necessary to allow for consensus building and understanding of the bills among Nigerians.

The meeting, which included a presentation by Oyedele, ultimately failed to persuade the governors regarding Tinubu’s plan to overhaul the taxation system aimed at achieving effective economic growth and increasing the tax-to-Gross Domestic Product ratio.

“Today (Thursday), NEC took a presentation from the Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms. The primary focus is fair taxation, responsible borrowing and sustainable spending,” Makinde stated.

“After extensive deliberation, NEC noted the need for sufficient alignment between and amongst the stakeholders for the proposed reforms.

“So, Council, therefore, recommend the need to withdraw the bill currently before the National Assembly on tax reforms so that we can have wider consultations and also build consensus around these reforms for the benefit of the entire country, and also to give people…for them to know the vision and where we are moving the country in terms of tax reforms because there is a lot of miscommunication, misinformation.

NATIONAL WAVES is of the view that much of the disapproval stems from lack of consultations with critical stakeholders. Nigeria is a complex country, and this sensitivity and complexity should be built into deliberation on any policy, and the cornerstone of this is communication.

Government should as a matter of policy make efforts to communicate well with not only the stakeholders but the people. This is a given in view of the fact that this is representative government, and the electorates are important, since they will bear the brunt of policy execution.

In future, efforts should be made to consult widely and to communicate to avoid a dysfunction such as is being currently witnessed in respect of the Tax Bill.

The current administration has not really been able to score high in consultations and communication; and this has often led to acrimony and poor image creation. This not good enough.

No matter the good intentions behind the bill the poor communication behind it and lack of consultations may have taken the shine off it, and there’s a lacuna for misinterpretation to the effect that the bill is meant to increase tax burden on the people. That’s why communication is a sinequanon.