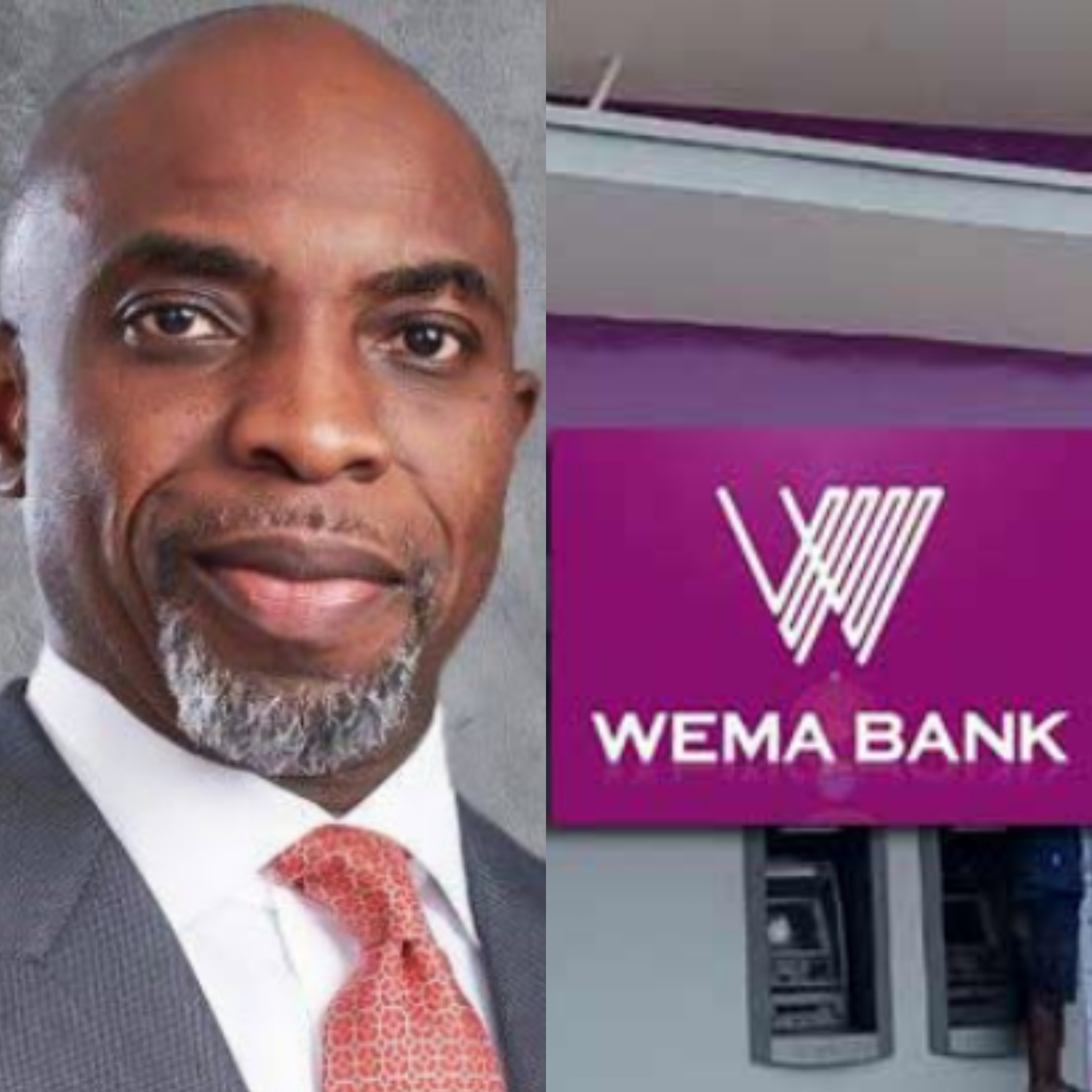

Moruf Oseni, WEMA Bank logo

By Our Reporter

Depositors and stakeholders of the Moruf Oseni-led Wema Bank Plc are contemplating moving their funds from the bank on account of the fraud cases the bank recorded in the year 2023.

In its full-year 2023 financial statement released recently, Wema Bank disclosed that it recorded fraud in its system to the tune of N1.136 billion.

This has become worrisome to financial analysts and further showed that the bank’s security system may be either weak, poor, not up to industry standard or operated by unqualified personnel.

Assuredly, this development does not only affect depositors and create panic in the minds of customers of the bank, it also has ripple effects on the dividend payout to its shareholders.

In the audited 2023 financial statement, the bank recorded 1,195 fraud cases to the tune of a whopping N1.136 billion, out of which N685.595 million was lost.

The bank claimed 97 per cent of the fraud cases were executed by outsiders, adding that the cases valued at N860.395 million occurred through operations and others and N595.017 million was lost in the process.

Internet fraud was worth N203.724 million and N90.017 million was ferried away by fraudsters.

Fraudsters also attempted to steal N36.071 million via point-of-sale channels and N8.148 million through mobile banking but only succeeded in carting away N506, 000.

Scammers also attempted to steal N869,000 via automated teller machines and N27.39 million web frauds, but they were foiled.

“There is no fraud, whether or not material, that involves management or other employees who have a significant role in the bank’s internal control system,” the management of the bank stated.