CBN Heaquarters

By our Reporter

The Central Bank of Nigeria has reiterated that old naira notes had not been banned and would remain legal tender in Nigeria.

The apex bank noted that there has been anxiety among members of the public over the legality or otherwise of old naira banknotes.

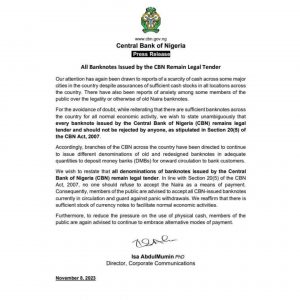

A statement signed on Wednesday by the CBN Director of Corporate Communications, Isa AbdulMumin, said there were sufficient banknotes for economic activities in the country.

He said, “Our attention has again been drawn to reports of a scarcity of cash across some major cities in the country despite assurances of sufficient cash stocks in all locations across the country. There have also been reports of anxiety among some members of the public over the legality or otherwise of old Naira banknotes.

“For the avoidance of doubt, while reiterating that there are sufficient banknotes across the country for all normal economic activity, we wish to state unambiguously that every banknote issued by the Central Bank of Nigeria (CBN) remains legal tender and should not be rejected by anyone, as stipulated in Section 20(5) of the CBN Act 2007.

“Accordingly, branches of the CBN across the country have been directed to continue to issue different denominations of old and redesigned banknotes in adequate quantities to deposit money banks (DMBs) for onward circulation to bank customers.

“We wish to restate that all denominations of banknotes issued by the Central Bank of Nigeria (CBN) remain legal tender. In line with Section 20(5) of the CBN Act 2007, no one should refuse to accept the Naira as a means of payment.

“Consequently, members of the public are advised to accept all CBN-issued banknotes currently in circulation and guard against panic withdrawals. We reaffirm that there is sufficient stock of currency notes to facilitate normal economic activities.

“Furthermore, to reduce the pressure on the use of physical cash, members of the public are again advised to continue to embrace alternative modes of payment.”