UBA logo

By Our Reporter

Gabriel Olatunde, a Lagos State resident, has narrated how N81,000 was stolen from his United Bank for Africa (UBA) account.

Olatunde told FIJ that the money was stolen from his account on December 7, after he attempted to withdraw some cash from an automated teller machine (ATM) situated at UBA’s head office in Marina, Lagos.

“I decided to make use of my UBA debit card at one of the ATMs situated at the bank’s head office in Marina on December 7, but unfortunately, it got swallowed by the machine,” Olatunde told FIJ on Thursday.

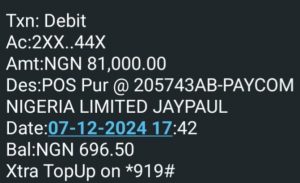

The Debit Alert Olatunde Received

“When I subsequently approached one of the guards on duty to call his attention to what had happened, he told me to come back on the following Monday, which was December 9, to officially lodge a complaint.

“The incident actually happened on a Saturday.”

On his way home, Olatunde received the shock of his life.

“As I headed home on the evening of December 7, hoping to return to the bank on Monday to officially lodge a complaint, I received a fraudulent debit alert of N81,000 on my account,” said Olatunde.

“The debit notification I received showed the fraud had been perpetrated via a web platform.

“It also meant that someone had retrieved my debit card after I left the premises and used it to wipe out all I had in my account through a web transaction.”

Olatunde told FIJ that he subsequently visited UBA’s head office on December 9 to complain and he was made to watch a video footage that did not eventually reveal the identity of the fraudster.

“The video did not reveal who the actual thief or fraudster was,” Olatunde said.

“I am still in shock as we speak. Things like these should not be happening to bank customers. How could my N81,000 have vanished just like that?”

When FIJ sent an email to UBA’s contact centre for a reaction to the incident on Thursday, one of the bank’s officials, who simply identified him or herself as Tolu O., issued the following response:

The confirmed repudiated transactions amounting to N81,000.00 were card present (CP) POS transactions carried out with instant debit Mastercard with pan 51*********0327 issued to and collected by you.

Investigation shows that the card PAN was read by the POS terminals used for the repudiated transactions confirming the person who carried out the transactions had custody of the physical card containing your card sensitive details/credentials.

United Bank for Africa was not negligent as the repudiated transactions were duly initiated and authorised with the card PAN details in custody of the customer and other privy card credentials known to you only.

In his or her response, the bank official failed to take cognisance of the fact that the email he responded to had been sent by this FIJ reporter and not the affected customer himself.

While attempting to absolve the bank of any wrongdoing, Tolu O. also failed to shed light on how Olatunde’s trapped debit card was retracted after he left the premises and then used to carry out a web transaction by unknown persons.

In November, FIJ investigated a trend of bank customers’ debit cards mysteriously getting trapped in ATMs. The trapped cards were always fraudulently used to steal millions of naira from their owners’ bank accounts.

The banks involved never took responsibility for the incidents. Also, none of the affected customers were able to get their funds back.