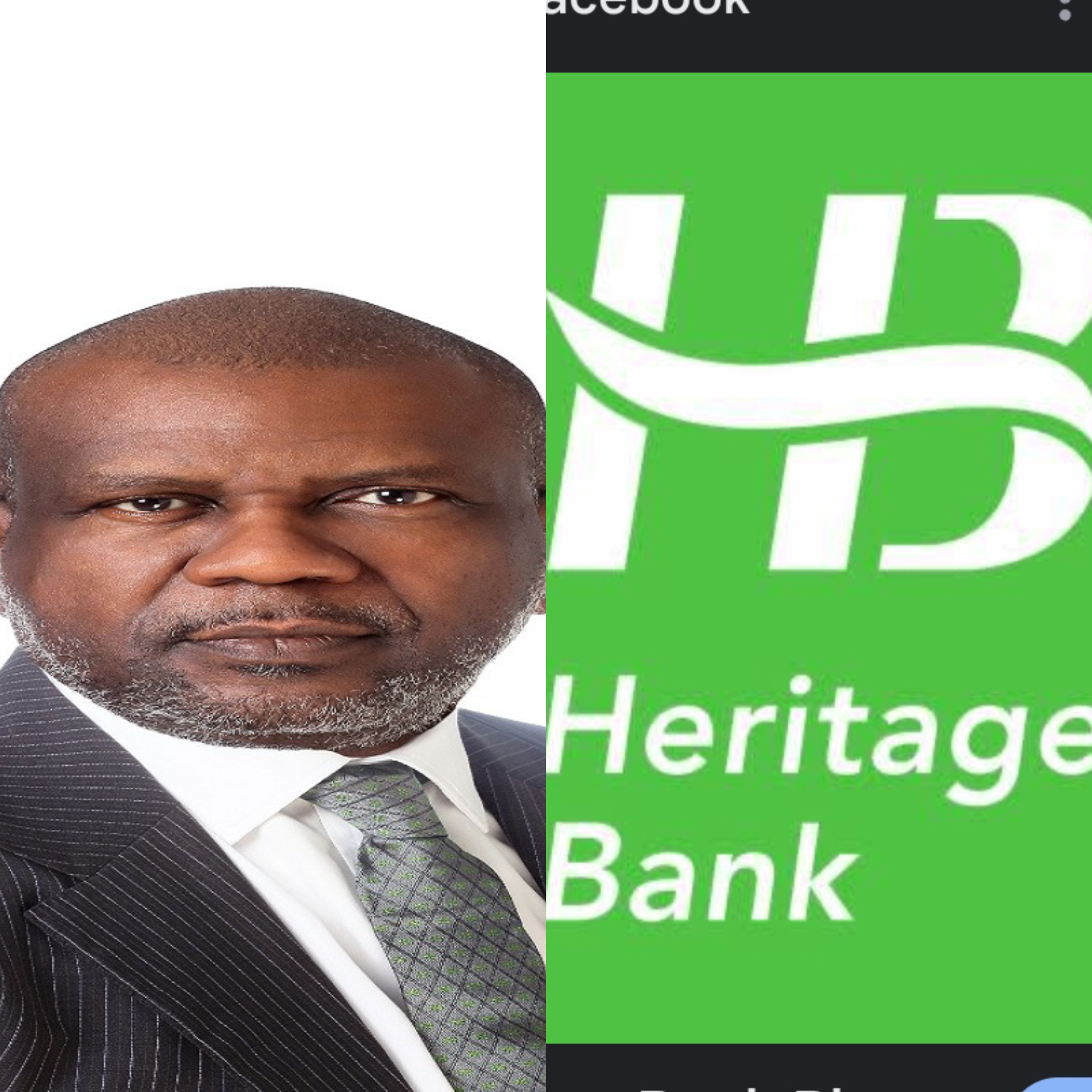

Akinola George-Taylor

By Our Reporter

With the unexpected collapse of Heritage Bank Plc, the once flourishing image of the Managing Director/Chief Executive Officer of the bank, Akinola George-Taylor

has been negatively affected.

Stakeholders were shocked to the marrow when the licence of Heritage Bank was revoked by the Central Bank of Nigeria (CBN) on June 3, 2024, due to financial instability, despite being led by this acclaimed financial expert.

George-Taylor steered the affairs of the bank for one year and ten months. His inability to salvage the bank from bankruptcy raises questions about his leadership and competence.

With over two decades of experience, George-Taylor was touted as a critical thinker and adept negotiator who could drive revenue and profit growth. However, his tenure at Heritage Bank was marked by a steady decline in the bank’s financial performance, culminating in the CBN’s decision to revoke its licence.

The CBN cited the bank’s failure to improve its financial performance, which posed a threat to financial stability, as the reason for the revocation.

Despite engagement and supervisory steps, the bank’s financial performance continued to deteriorate, leaving no reasonable prospects of recovery.

The revocation of the licence was deemed necessary to strengthen public confidence in the banking system and ensure the soundness of the financial system.

The Nigeria Deposit Insurance Corporation (NDIC) has been appointed as the Liquidator of the bank, in accordance with Section 12 (2) of BOFIA, 2020.

The CBN assured the public that the Nigerian financial system remains on a solid footing and that the action taken against Heritage Bank reflects its continued commitment to ensuring the safety and soundness of the financial system.

George-Taylor’s tenure at Heritage Bank has raised questions about his leadership and competence, and the revocation of the bank’s licence has sparked concerns about the impact on depositors and the wider financial system.

As the NDIC takes over as Liquidator, the focus now shifts to recovering debts and ensuring that depositors’ funds are protected.

Before joining Heritage Bank Limited, Akinola George-Taylor held various leadership roles in different organizations. He served as a Non-Executive Director at Freetown Waste Management Recycle Limited (FREEEE) and Sage Grey Finance Limited. Additionally, he was a Director at Apel Asset Trust Limited, a specialized financial services firm that provides comprehensive financial solutions in securities trading, corporate finance, and asset management.

George-Taylor also founded and served as the Chief Executive Officer of FAFE International, a financial advisory company that caters to clients in the oil and gas, power, and real estate sectors. Furthermore, he had a distinguished 19-year and 8-month career at GTBank Plc, where he held various positions, including Executive Director, Divisional Director of the Public Sector Group, and Managing Director of GTBank Sierra Leone.